Improve visibility and control with business credit cards

For finance teams and managers, a Mobilexpense business credit card offers:

Reduced risk of fraud and the hassle that traditional bank cards offer.

A centralised place to manage all company expenses in one desktop and mobile app.

/Company%20Cards_Above%20Fold%20.jpg?width=800&height=715&name=Company%20Cards_Above%20Fold%20.jpg)

3.000+ companies count on Mobilexpense for expense management

Online company card management

Easily order, freeze, block and manage all business credit cards cards online, without setting foot in the bank.

Empower your employees, stay in control

Eliminating out-of-pocket expenses while still ensuring full control over company spending.

0% FX mark-up on business credit cards

No hidden fees, just great company credit card policy enforcement and a 0% markup on foreign exchange when travelling internationally.

Virtual or physical? You decide.

Mobilexpense business credit cards are versatile and practical, allowing for both online and in-store payments, whether recurring or one-time, making them user-friendly for all in your company.

/_E3A2687%20(PSD).jpg?width=800&height=500&name=_E3A2687%20(PSD).jpg)

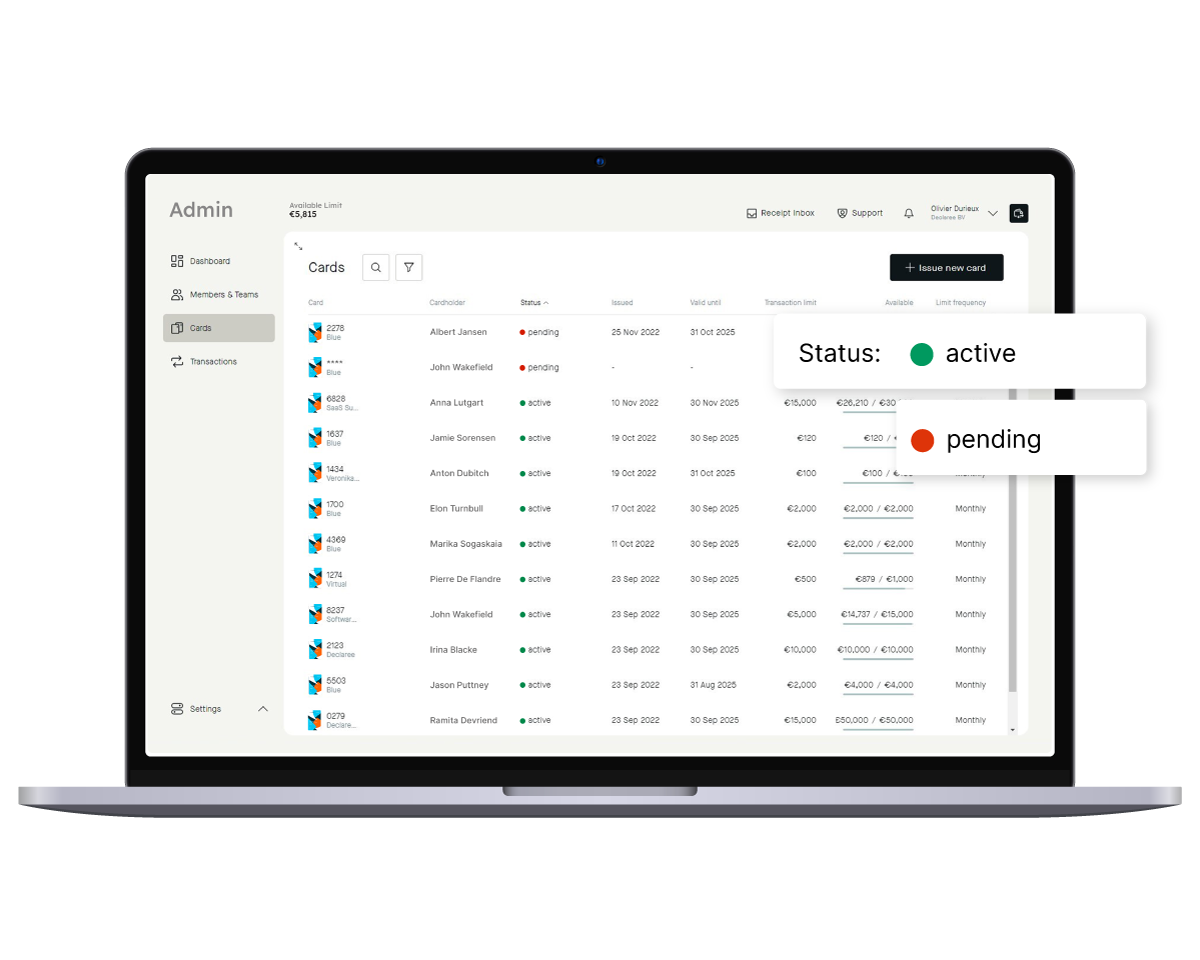

Control business spendings with company cards

Our expense cards for employees allow you to monitor transactions in real-time, ensuring adherence to spending limits and company policies. You set spending limits for your employee expense cards per period or transaction for each corporate credit card.

/Mobilexpense%20Cards%20-%20Website%20Mockup.jpg?width=800&height=419&name=Mobilexpense%20Cards%20-%20Website%20Mockup.jpg)

Manage all business credit cards online and in real-time

With automated policy enforcement and Apple Pay compatibility, Mobilexpense cards bring effortless compliance, transparency, and convenience to business spending. Minimise the risk of overspending with a live view of your company expense cards.

/Mobilexpense%20Card%20Payment.jpg?width=800&height=479&name=Mobilexpense%20Card%20Payment.jpg)

Manage all business credit cards online and in real-time

Instantly issue or block business credit cards, manage lost cards, pin codes and more from our online application’s central dashboard. Manage spend and employee cards from one application. And you won't ever have to set foot in a bank.

Automated policy enforcement ensures that expenses are compliant. Combined with a real-time view on expenses, overspending becomes nearly impossible.

These customers use our CO2 emissions tracking tool

Understanding the Dutch Government's CO2 Reporting Requirements

In response to the growing concerns about climate change and the Netherlands' commitment to reducing CO2 emissions, the Dutch government introduced new legislation to monitor and manage the environmental impact of work-related travel. This legislation, known as the "Rapportageverplichting werkgebonden personenmobiliteit (WPM)", mandates organisations with a workforce of 100 or more to provide detailed reports on the CO2 emissions resulting from their employees' business and commuting travels.

Starting from 1 January 2024, if your organisation falls into this category, you'll be required to maintain a record of the CO2 emissions from both business trips and daily commutes of your employees. This data will play a crucial role in the country's efforts to understand and reduce the carbon footprint of work-related travels, which currently account for a significant portion of the total kilometers driven in the Netherlands. The deadline for submitting the required data for the year 2024 is set for 30 June 2025.

This move by the government not only emphasizes the importance of environmental responsibility but also underscores the role employers play in promoting sustainable travel options and practices.

For a comprehensive understanding of these requirements and to ensure your organization remains compliant, the official RVO website offers detailed insights.

-3.png)

Join the movement of CO2 emissions tracking

CO2 emissions tracking is at the forefront of sustainable business practices. Find out more about what emissions tracking is, why it's necessary, the tools you can use for it and the benefits for your company - and the planet.

Customers using our company cards

"Mobilexpense is a real game-changer for us."

Our Mobilexpense solution is a real game-changer for us. With the convenience of self-issued credit cards for employees and seamless integration of claims data for administration, we not only save valuable time but also have complete control over our expenses. Efficiency and convenience come together in this super service. For our international projects, we now even give temporary cards to freelancers with a set expiry date. For office workers, a virtual card. Super convenient.

"[We] have reduced the time needed to manage expenses by 50%."

The integration of credit cards with the expense application has reduced the amount of lost receipts, accelerated the expense claims and contributes to a general smoothening of our expense management. It was easily deployed and accepted by the people and has reduced the time needed to manage expenses by 50%.

"It's a win-win for efficiency and trust!"

The new Mobilexpense cards provide complete card management for us at Ovotrack, making it super easy to order and distribute new cards, but also to set limits to transactions or monthly spend, and have real-time insight in all transactions. Our employees value their independence and the ability to manage their spending in real-time using either a plastic or virtual card, directly linked to their mobile app. It's a win-win for efficiency and trust!

#1 employee expense cards for CFOs and finance teams

All our expense solutions meet the latest regulatory updates and prioritise data safety. Our dedicated Compliance Team ensures that we maintain ISO 27001:2013, ISAE 3402 Type II, and PCI DSS certifications.

All our customers benefit from free, personalised support and guidance for their expense management challenges.

|

/_E3A2940.jpg?width=900&height=600&name=_E3A2940.jpg)

Time saved on expenses

Mobilexpense saves companies 95% on their travel and expense management processes.

Mobile expense app downloads

Experience the power of our trusted mobile travel and expense app to effortlessly manage your expenses.

.png?width=1920&height=1080&name=%5BE-book%5D%20Cover%20Mockup%20Image%20(2).png)

/_E3A2407.jpg?width=2048&height=1365&name=_E3A2407.jpg)