Virtual & plastic cards

Choose the type of business credit cards that best suit your organisation and the way your employees use them.

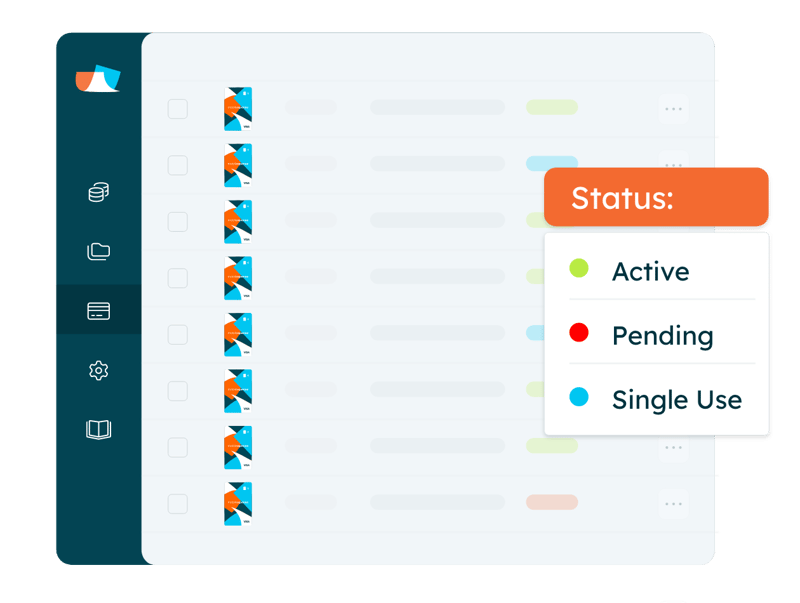

Online card management

Easily order, freeze, block and manage all business credit cards online, without setting foot in the bank.

0% FX mark-up

With Mobilexpense cards, enjoy a 0% mark-up on foreign exchange when travelling internationally.

No more out-of-pocket business spending with company credit cards

Offer your employees their own business credit card and let them say goodbye to advancing money out-of-pocket for their expenses and other, costlier, company spend.

Mobilexpense business credit cards can be used to make payments both online and in-store, recurring or one time, making them practical and easy to use for everyone in your company.

.png?width=800&height=603&name=%5BSolution%5D%20Cards%20(ENG).png)

Control spending with company cards

Set spending limits per period or per transaction for each Mobilexpense business credit card, and determine the transactions that require justification. Create a card per vendor, for example to easily keep an eye on your ad spend or event marketing costs.

Transactions are monitored in real-time. Each one is checked against spend limits, company policy, and business rules. This makes it impossible to overspend your balance.

.png?width=800&height=585&name=%5BSolution%5D%20Cards_No%20OoP%20(ENG).png)

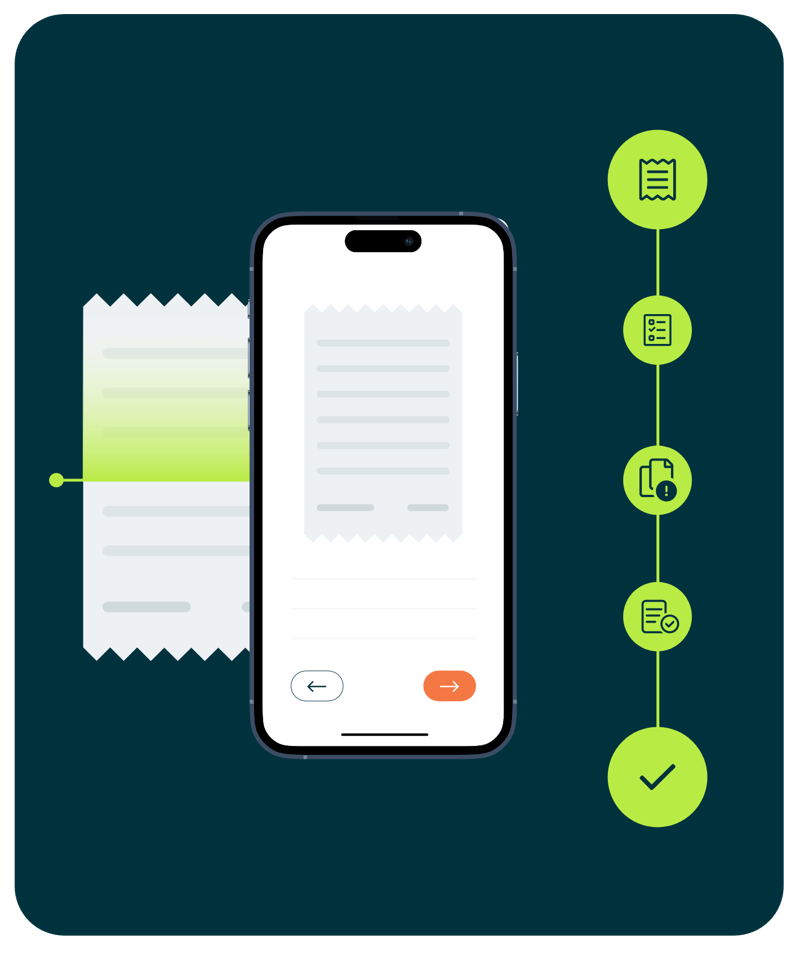

Say goodbye to chasing receipts

Employees receive push notifications to add a receipt for each business credit card transaction, resulting in instant justification of incurred costs. They simply take a picture of the credit card receipt with their smartphone or forward us their invoice, and that's it. The receipt data is then automatically extracted and matched thanks to OCR.

.png?width=800&height=595&name=%5BSolution%5D%20Cards_No%20receipt%20chasing%20(ENG).png)

Manage all business credit cards online and in real-time

Instantly issue or block business credit cards, manage lost cards, pin codes and more from our online application’s central dashboard. Manage all spend and employee cards from one application. And you won't ever have to set foot in a bank.

Automated policy enforcement ensures that all spend is compliant. Combined with a real-time view on expenses, overspending becomes nearly impossible.

Introducing Apple Pay. Your iPhone is now your wallet.

Apple Pay is an easy, secure and private way to pay — in-store, online and even in your favourite apps. [Now] Available with your Mobilexpense card on your iPhone, Apple Watch, iPad and Mac.

Get a complete overview with less manual work

Scan

Approve

Control

These customers use Mobilexpense cards

Mobilexpense is a real game-changer for us. With the convenience of self-issued credit cards for employees and seamless integration of claims data for administration, we not only save valuable time but also have complete control over our expenses.

We have reduced the time required to manage expenses by 50%. The integration of credit cards with the expense application has reduced the amount of lost receipts, accelerated the expense claims and contributed to a general smoothening of our expense management.

The Mobilexpense cards provide complete card management for us at Ovotrack, making it super easy to order and distribute new cards, but also to set limits to transactions or monthly spend, and have real-time insight in all transactions. It's a win-win for efficiency and trust!

Job Beekhuis

Managing Director at Ovotrack

Frequently asked questions

Mobilexpense offers modern corporate credit cards. Our convenient and easy-to-use card management platform allows for flexible setting of card limits and real-time reporting and seamlessly integrates with your existing setup of accounting and travel expense management tools and processes.

Registered corporations and private companies, associations and partnerships with good credit rating and sufficient credit card spend.

Mobilexpense offers Visa credit cards, both virtual and physical. Regarding physical cards, customers can choose between Blue (Visa Platinum Business) and Black (Visa Infinite Business credit cards). Mobilexpense is neither a prepaid nor a debit card and, therefore, is bank account independent, offers maximum card acceptance, and does not need to be charged in advance.

Virtual cards work the same way as physical cards, only that no plastic version of the card is provided, with card data being only accessible via your Mobilexpense app. Advantages of virtual cards include their instant availability. They also cannot be lost and are offered with a range of flexible usability options. Since they are offered at no extra cost, separate virtual cards can be issued for specific merchants or purchases with individual settings tailored to the specific use case. That way, if something is wrong with one card, there is no need to update card data across multiple merchants.

Mobilexpense assigns security and data protection the highest priority. All personal data is stored in accordance with the European General Data Protection Regulation (GDPR). Critical card data are stored and processed in line with the very high data security standards of the payment card industry (PCI DSS). Additionally, Mobilexpense cards are enabled for 3DS to ensure additional protection for online purchases.

3D Secure is a free service facilitated by VISA that lets you transact securely on “Verified by Visa“ / “Visa Secure” online merchants using your Mobilexpense credit cards. It adds a security layer via an additional verification step. During this verification, you must provide a one-time password that is only available to you.

All Mobilexpense credit cards are automatically equipped with 3D Secure. During your online purchase you will receive the one-time password via SMS for the verification. You can then input this password into the verification page that will show the Visa logo and confirm the payment by clicking confirm / send. If the password is correct, the transaction will be successful and otherwise declined. Mobilexpense credit cards also work at merchants that do not participate in Visa 3D secure program.

This service is offered due to the EU’s Second Payment Services Directive (PSD2) which will mandate Strong Customer Authentication (SCA) before initiation of the payment. Therefore, Visa recently enhanced its security for online purchases including both e-commerce and m-commerce transactions to satisfy this new standard.

Learn more about Visa 3D Secure.

Cards are issued by Pliant Oy, identified by business ID 3266913-9, in accordance with a license from VISA Europe Limited. Pliant OY is recognized as an Authorized E-money payment institution and duly authorised and regulated by the the Financial Supervisory Authority of Finland.

*Terms and conditions apply.

.png?width=800&height=633&name=%5BSolution%5D%20Cards_Above%20fold%20(ENG).png)